Madaloan

«Madaloan» - Loan company summary:

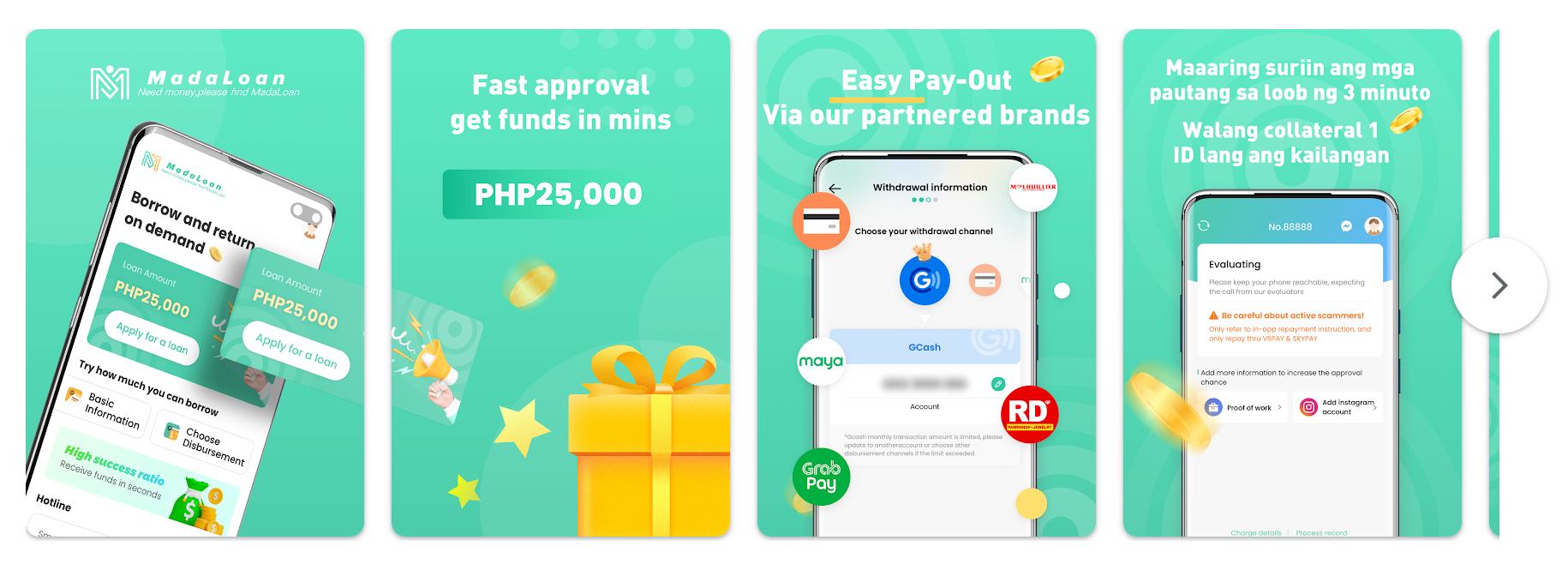

MadaLoan easy lend pera peso. is a convenient, free mobile app designed to help Filipinos secure loans for any financial needs. Whether it’s for an unexpected medical expense or a major purchase like a new home, the app offers quick access to loans ranging from ₱3,000 PHP to ₱50,000 PHP, with competitive interest rates. Users can enjoy the flexibility of various repayment methods—both digital and traditional—making the loan process stress-free.

Once your loan application is approved, you can receive the funds in as little as five minutes. However, it’s important to note that MadaLoan is exclusively available to Filipino citizens residing in the Philippines, and cannot be used by those living abroad.

What is MadaLoan?

MadaLoan easy lend pera peso. is an essential app for any Filipino in need of fast financial assistance. The app provides loan terms ranging from 91 to 180 days, with loan amounts between ₱3,000 PHP and ₱50,000 PHP, and interest rates capped at a maximum of 29% annually. In addition to the interest, there is a small fee for online or offline transactions, and a minimal 0.1% service charge when securing a loan.

What sets MadaLoan apart is its flexible interest rate adjustments, which can be tailored to your credit profile or current financial needs. The app offers a variety of repayment options, including payments via e-wallets, pawnshops, and convenience stores, ensuring that making your loan repayment is always simple and accessible. Moreover, the platform takes your privacy seriously, with all your personal information protected under the oversight of the Securities and Exchange Commission (SEC).

Is MadaLoan Legit?

When considering a loan provider, it’s crucial to choose a reputable company to avoid potential scams that could jeopardize your financial well-being. MadaLoan app is a fully legitimate and regulated financial technology company, registered with the SEC (SEC Registration No. 2021090025243-01; Certificate of Authority No. L-21-0061-15). Specializing in personal loans, MadaLoan offers a completely online process that ensures quick and straightforward access to funds.

With its user-friendly application process, multiple repayment options, and transparent terms, MadaLoan aims to make borrowing both simple and fair for all users. Whether you’re in need of emergency funds or planning a large purchase, MadaLoan strives to make the borrowing process easy, transparent, and secure.

How to Get MadaLoan

MadaLoan easy lend pera peso. stands out as a top choice for those seeking hassle-free loans in the Philippines. One of its greatest advantages is the simplicity of the application process—all steps can be completed on a mobile phone. Borrowers don’t need to waste time or money visiting physical branches to start their loan journey.

To apply for a loan through MadaLoan, follow these simple steps:

- Install the official MadaLoan app on your mobile device.

- Register your account using a government-issued ID for identity verification.

- Provide personal and financial details, including your employment information, proof of income, and other required data.

- Wait for your loan application to be processed. Approvals typically take less than five minutes, with funds disbursed within 60 minutes after approval.

With this streamlined process, MadaLoan ensures that borrowers receive financial assistance without delays or unnecessary complications.

MadaLoan Loan Requirements

Before applying for a loan with MadaLoan app, it’s essential to familiarize yourself with the necessary requirements. The maximum credit limit on MadaLoan is ₱8,000 PHP, but eligibility depends on meeting specific criteria. Here’s what you’ll need:

- Be at least 18 years old.

- Have a stable source of income, which must be verified with documents such as proof of income, Certificate of Employment (COE), payslips, or bank statements.

- Possess a government-issued ID to verify your legal eligibility.

- Provide personal information, including your address, contact details, and, if applicable, spouse’s information.

By ensuring these criteria are met, applicants increase their chances of successfully securing a loan.

How to Pay Your MadaLoan Loan

MadaLoan offers borrowers multiple flexible repayment options, making it easy to settle their loans on time. Payments can be made directly through the app using a bank card, or through alternative methods such as:

- PayMaya (an e-wallet similar to GCash)

- 7-Eleven outlets

- Pawnshops

- M Lhuillier, and more.

With so many payment options, borrowers can choose the method that best suits their convenience.

What Happens If I Have an Unpaid MadaLoan Loan?

Life’s uncertainties may sometimes lead to difficulties in repaying loans. If you fail to pay your MadaLoan loan by the due date, a late fee will be applied immediately. This fee will increase based on the number of days your payment is overdue.

It’s essential to monitor your repayment schedule to avoid additional charges and unnecessary stress.

Consequences of Not Paying Your Loan

Failure to repay your MadaLoan loan can lead to serious consequences. Borrowers should be aware of potential outcomes, including:

- Damage to your credit score, which can impact future borrowing opportunities.

- Debt collectors contacting you or visiting your residence.

- Legal action initiated by the lender to recover unpaid amounts.

To prevent these situations, borrowers are advised to stay on top of their payment schedules and reach out to customer service if they encounter financial challenges.

MadaLoan Customer Service

MadaLoan’s customer support team is always ready to assist users with any concerns or questions. Customers can contact the company through the following channels:

- Physical address

- Phone number

- Email address

For immediate assistance, MadaLoan app also offers a live chat feature on their website. This tool is designed to provide real-time support, ensuring that customers receive timely and effective solutions.

By maintaining open communication with their support team, borrowers can navigate any issues with ease and confidence.

On the partner site