Funpera loan app

«Funpera» - Loan company summary:

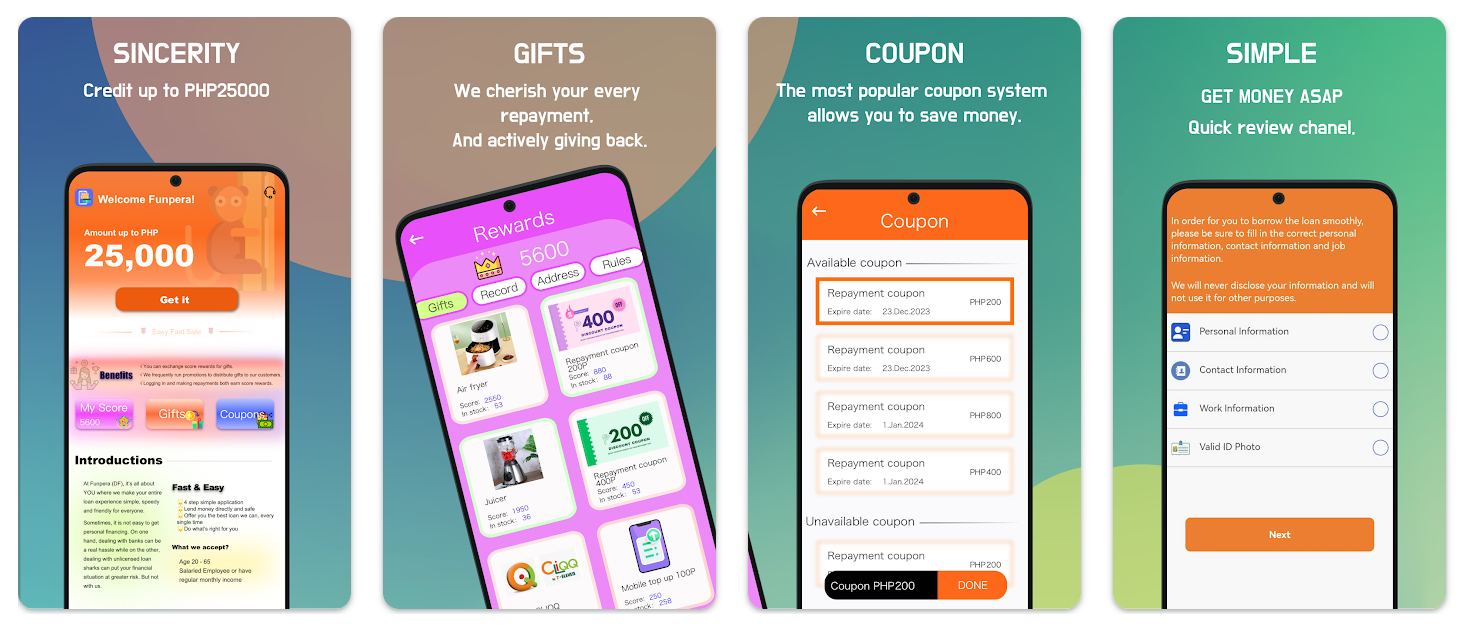

The Funpera loan app is a revolutionary personal finance platform designed to offer users the convenience of borrowing money online through the internet or mobile devices. Recognized as one of the fastest and most reliable loan apps available today, Funpera has gained the trust of countless customers seeking quick and hassle-free financial assistance. With no strict borrowing limits and only a valid ID card required, users can access diverse loan amounts at competitive interest rates. This makes Funpera an ideal choice for those seeking online lending options in the Philippines without the time-consuming processes of traditional methods.

Funpera stands as a reliable alternative to complex bank loans, offering flexibility and accessibility. Through Funpera, users can secure loans of up to PHP 20,000, making it a practical solution for urgent financial needs.

Funpera.ph Loan App Registered Financial Platform

The Funpera lending app operates as a legitimate financial service registered with Philippine government authorities. Users can verify its registration on the official SEC (Securities and Exchange Commission) website at sec.gov.ph.

To ensure safety, it is highly recommended to download the Funpera app only from official sources like Google Playstore or Apple App Store. Avoid downloading through third-party links or unauthorized APK files to prevent potential risks of downloading counterfeit versions of the app.

While commonly referred to as the Funpera app loan in the Philippines, the platform is officially registered under DF Credit Lending Corporation, reinforcing its credibility and compliance with Philippine financial regulations.

Is Funpera Legal?

The legitimacy of financial companies operating in the Philippines is governed by strict legal requirements. All such businesses must secure the necessary permissions from the SEC to function lawfully. Funpera meets these stringent requirements and is listed as follows:

- Company Name: DF Credit Lending Corporation

- Registration No.: CS202002430

- Certificate of Authority: 3244

- Anniversary Date: September 17, 2015

This certification confirms that Funpera adheres to all regulatory standards, ensuring its services are both legitimate and trustworthy.

Amid a surge in financial scams during the pandemic, individuals are urged to exercise caution when choosing a lender. To avoid falling victim to fraudulent schemes, it is essential to confirm the legitimacy of any financial institution. For Funpera, this can be done by checking the SEC website or searching for “FunPera Philippines SEC” online.

The company is transparently listed on the SEC platform under its legal name, DF Credit Lending Corporation, with the above-mentioned registration details. This ensures that customers can confidently rely on Funpera as a secure and lawful financial partner.

Guide to Applying for a Loan at Funpera

Step 1: Visit the Website or Download the App

To get started, navigate to Funpera’s official website using a web browser on your mobile device or computer. Alternatively, you can download the Funpera app from trusted platforms like Google Playstore or Apple App Store.

Step 2: Create an Account

If you are a new user, you’ll need to register for a Funpera account. This involves the following simple steps:

- Enter your full name.

- Provide a valid email address.

- Create a secure and unique password to protect your account.

Step 3: Complete the Required Information

Funpera requires some essential details for the loan application process. Be prepared to provide:

- Personal Information: Name, date of birth, gender, and address.

- Financial Details: Monthly income, occupation, and, if necessary, banking details.

- Contact Information: Mobile phone number and other relevant details.

Step 4: Select a Loan Product and Amount

Based on the loan products Funpera offers, choose the one that best suits your needs. During this stage, you will also decide on the loan amount. Keep in mind that Funpera will display details like interest rates and maximum loan limits to help you make an informed decision.

Step 5: Wait for Approval

Once you’ve submitted your application, Funpera will review your information and assess your ability to repay. Approval times can vary depending on their procedures. Remain patient while awaiting the outcome.

FunPera Loan Requirements

Like all lending platforms, FunPera has specific requirements for borrowers. While meeting these criteria is necessary, the amount you can borrow depends on your credit history with FunPera. Below are the basic requirements:

- Applicants must be at least 21 years old.

- Must be a citizen of the Philippines.

- Have a minimum monthly income of PHP 10,000.

- Provide a government-issued ID.

- Have a mobile or landline contact number.

How to Repay the Loan

FunPera makes repayment convenient with multiple options. Payments can be made at the following locations:

- 7-Eleven

- Payment Centers

- SM Department Stores, Supermarkets, Payment Counters, and Savemore

- Robinsons Department Stores and Supermarkets

- BPI (Bank of the Philippine Islands)

- Cebuana Lhuillier

You can choose to pay in full or partially before the due date. Flexible repayment plans help borrowers stay on track with payments.

What Happens if You Miss a Payment

Failing to pay your FunPera loan on time can lead to several consequences:

- Loan Ineligibility: You won’t be able to take another loan until the outstanding balance is fully repaid.

- Credit Score Impact: Non-payment can negatively affect your credit score.

- Potential Blacklisting: FunPera may blacklist you from using their platform in the future.

- Debt Collection Harassment: Although FunPera is known for being fair, late payments may result in follow-ups from collection agencies.

To avoid these issues, it’s recommended to keep track of your payment deadlines and settle dues promptly.

What If the Loan Remains Unpaid?

If your loan remains unpaid, FunPera may:

- Add late fees and additional charges to your outstanding balance.

- Assign agents to contact you regarding the overdue amount.

- In extreme cases, involve third-party debt collectors or pursue legal action.

Being mindful of these potential outcomes can help borrowers manage their loans responsibly.

FunPera Fees and Charges

FunPera applies a processing fee of 2% on all loans. Other than this, the platform does not disclose additional charges. Borrowers are encouraged to review the loan terms carefully before proceeding.

Customer Support

FunPera offers customer support for inquiries and assistance through the following channels:

- Email: You can contact them at [email protected].

- Facebook Page: FunPera maintains an active presence on social media for customer interactions.

- Website: Further details are available on their official website.

While FunPera operates physical branches, their exact locations are not mentioned on their website or Facebook page. Borrowers can rely on the digital channels provided for quick support.

On the partner site