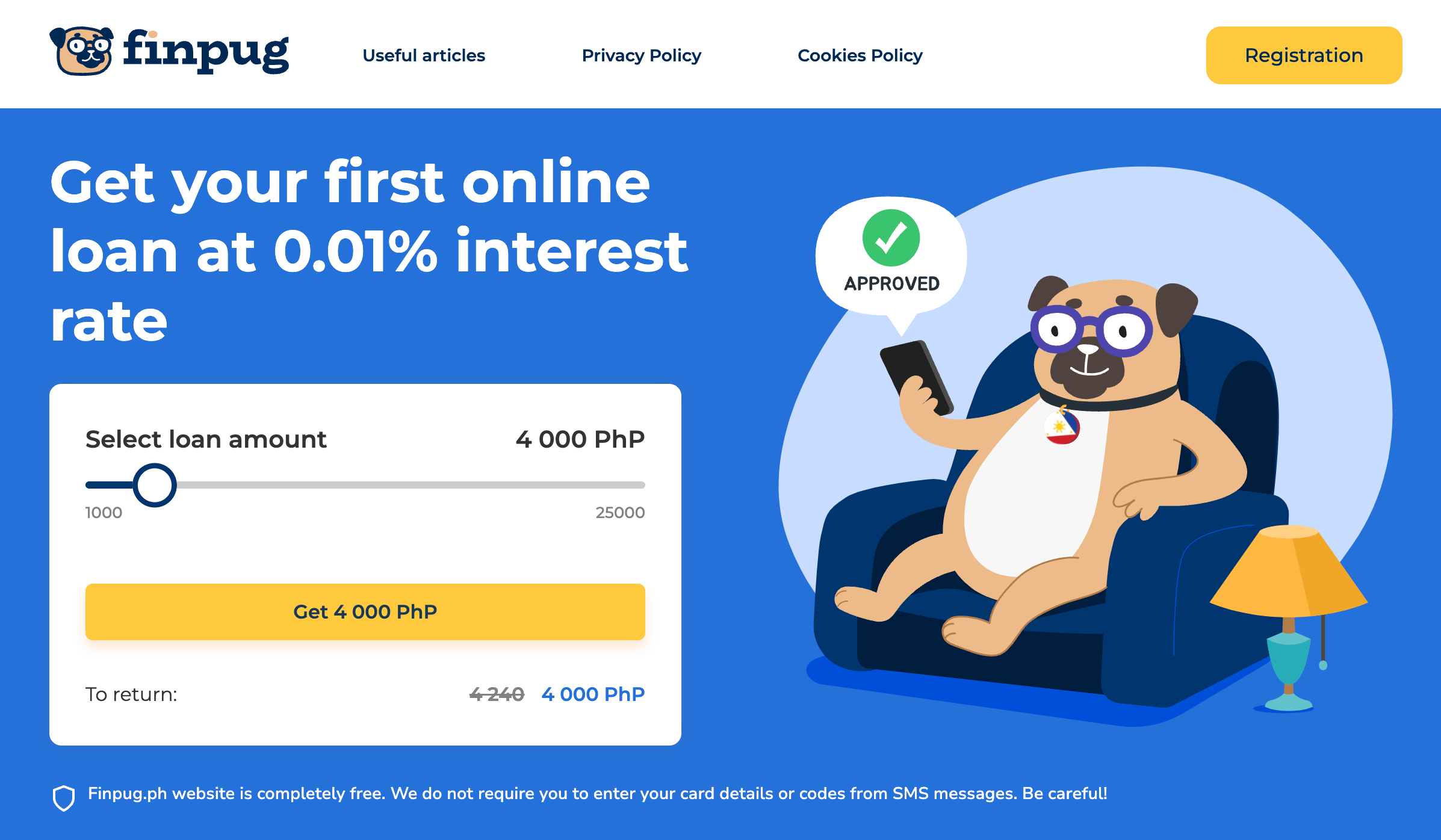

Finpug Loan Review

«Finpug» - Loan company summary:

Finpug is a reputable online lending company in the Philippines, providing fast and accessible loan services to Filipino citizens. Whether you’re facing unexpected expenses or simply need a financial boost, Finpug aims to meet your short-term financial needs through an efficient and user-friendly platform.

Is Finpug Legitimate?

Finpug Philippines operates primarily as an informational platform, connecting users with potential lenders but not directly involved in the loan agreements themselves. The platform does not charge service fees and remains a neutral party, unaffiliated with any specific lenders. This impartiality ensures that Finpug is not responsible for the actions or policies of the lenders it features, including interest rates or contractual terms, thus maintaining its integrity as a reliable resource for financial guidance.

Why Might You Need a Loan?

Finpug Philippines recognizes the diverse financial needs of its users. Whether you’re managing existing debts, dealing with unexpected expenses, or planning for something special, Finpug offers loans designed to fit a variety of situations. Common loan purposes include:

- Debt Consolidation: Combine multiple debts into one, making it easier to manage your finances.

- Living Expenses: Use a loan to cover essential costs during tight financial periods.

- Travel: Fund your vacation plans without straining your immediate budget.

- Medical Expenses: Secure funds for medical treatments, whether urgent or planned.

- Home Repairs: Address necessary home repairs quickly.

- Housing Deposits: Get help with rental deposits or other housing-related costs.

- Car Repairs: Finance necessary vehicle repairs to get back on the road.

- Other Personal Needs: Whatever your financial needs, Finpug offers flexible loan solutions.

How Does Finpug Work?

Finpug is designed for efficiency and ease, providing a seamless experience for those looking for quick financial solutions. Here’s a step-by-step guide to how it works:

- Easy Registration: Start by filling out a quick registration form on the Finpug website, which takes just a few minutes.

- Access Loan Offers: Once registered, explore various loan offers that match your needs. Finpug recommends applying to multiple lenders to increase your chances of approval.

- Submit Your Details: Provide your personal information directly to the chosen lender’s website. Finpug ensures that your data is secure and confidential.

- Receive Loan Approval: After submitting your application, expect loan approval within 15 to 30 minutes, making it a fast and convenient process.

Finpug Loan Requirements

Applying for a loan through Finpug is straightforward, but it’s essential to be aware of the basic requirements to improve your chances of approval. The maximum loan amount available is PHP 25,000, catering to a range of financial needs. To qualify, you’ll need:

- Valid ID: Proof of identity and age.

- Employment Information: Details about your job to assess your repayment capability.

- Personal Information: Including your address, spouse’s name, and contact number.

Being prepared with the necessary documents will speed up your loan application process and make it more efficient.

Loan Amount and Terms

Finpug offers flexible loan amounts ranging from PHP 1,000 to PHP 25,000, making it suitable for borrowers with varying financial requirements. Whether you need a small loan to cover daily expenses or a larger amount for urgent bills, Finpug provides a tailored solution that fits your situation.

Interest Rate

The interest rate at Finpug is set at a competitive 1% per day, ensuring transparency and straightforward calculations. While this daily interest rate might seem high, it is designed for short-term borrowing, making it ideal for those looking to borrow money for just a few days or weeks. The company encourages responsible borrowing by offering clear terms, so customers are fully aware of the costs involved before taking out a loan.

Loan Term

Finpug provides highly flexible loan terms, allowing borrowers to choose repayment periods between 7 to 365 days. Whether you need a quick loan with a short repayment period or a longer-term loan with manageable installments, Finpug accommodates different financial situations and repayment capabilities.

How to Repay a Finpug Loan

Finpug offers several convenient repayment options, making it easy to settle your loan. You can repay through the Finpug mobile app using your bank card, or choose from other methods:

- Electronic Wallets: Use e-wallets like PayMaya for easy payments.

- Convenience Stores: Pay at 7-Eleven stores, available 24/7.

- Pawnshops and Payment Centers: Local pawnshops and branches of M Lhuillier also accept payments, offering multiple options depending on your location.

With flexible repayment solutions, Finpug ensures that managing your loan is as simple as obtaining it.

Mobile App Convenience

In addition to their web-based platform, Finpug offers a mobile application, providing even greater convenience to its users. The app is designed to allow users to apply for loans, check their balance, and make repayments directly from their smartphones. This feature is particularly beneficial for busy individuals who prefer managing their financial needs on the go.

Can I Get Multiple Loans at the Same Time?

Yes, it is possible to apply for and receive multiple loans simultaneously from different financial institutions. While there are no legal restrictions preventing individuals from acquiring more than one loan, it’s essential to approach this with caution. Managing several loans at once can significantly increase your financial burden, so it’s important to carefully plan your repayment strategy. Before taking on multiple loans, assess your financial situation thoroughly to ensure you can meet the repayment obligations without overstretching your budget.

How Long Will It Take to Receive Money in My Bank Account or Card?

Finpug prioritizes fast disbursement, with funds typically transferred to your bank account or card within 30 minutes of approval. However, the speed of the transfer can depend on factors like the time and day of the application. Applications submitted during business hours tend to process more quickly, while those made on weekends or outside working hours may experience slight delays. Understanding these timelines can help you plan your application more effectively to ensure timely access to the funds when you need them most.

How to Repay a Loan?

Repaying a Finpug loan is simple, but it’s important to follow the lender’s specific guidelines. Borrowers must repay the loan to the same financial institution from which the funds were borrowed. Each lender has its own repayment procedures, so it’s crucial to carefully review the terms and methods outlined before agreeing to the loan. Familiarizing yourself with these details can help you avoid any complications and ensure a smooth repayment process, supporting your financial health and maintaining a positive credit profile.

Finpug stands out as a reliable and efficient loan provider in the Philippines, offering flexible loan amounts, clear interest rates, and accessible repayment terms. With the added benefit of a mobile app, it provides a seamless borrowing experience for individuals seeking quick and hassle-free financial solutions. If you need fast cash with straightforward terms, Finpug is worth considering.

On the partner site

Best MFOs

- «Finpug» - Loan company summary:

- Is Finpug Legitimate?

- Why Might You Need a Loan?

- How Does Finpug Work?

- Finpug Loan Requirements

- Loan Amount and Terms

- Interest Rate

- Loan Term

- How to Repay a Finpug Loan

- Mobile App Convenience

- Can I Get Multiple Loans at the Same Time?

- How Long Will It Take to Receive Money in My Bank Account or Card?

- How to Repay a Loan?

02.10.24 16:20

I needed the money urgently, and they delivered exactly as promised.

18.09.24 19:00

It’s great that everything was online, and I didn’t have to deal with paperwork.