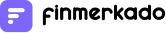

Finmerkado Loan Review

«Finmerkado» - Loan company summary:

In the dynamic landscape of financial services in the Philippines, Finmerkado emerges as a notable player in the realm of personal loans. Offering a range of loan products tailored to meet diverse financial needs, Finmerkado is positioned as a reliable microfinance institution (MFI) that caters to Filipinos seeking quick and flexible financial solutions.

The Essence of Personal Loans

A personal loan is a versatile financial tool designed to provide borrowers with the necessary funds to address various personal expenses. Unlike secured loans, personal loans typically do not require collateral, making them accessible to a broader range of individuals. Borrowers can use personal loans for various purposes, such as settling bills, covering housing expenses, paying tuition fees, handling healthcare costs, financing home repairs, or even funding travel.

Distinctive Features of Finmerkado’s Personal Loans

- No Collateral Required: One of the standout features of Finmerkado’s personal loans is that they are unsecured. This means that borrowers are not required to pledge any assets, such as real estate or vehicles, as collateral. This feature makes Finmerkado’s loans particularly appealing to those who may not have significant assets to offer as security.

- Customizable Loan Terms: Finmerkado provides flexible loan terms that can be tailored to suit the borrower’s financial situation. Whether a borrower seeks a shorter repayment period to quickly settle their debt or prefers a longer-term repayment plan to ease monthly payments, Finmerkado offers options that can be customized to align with individual financial goals.

- Swift Approval Process: In today’s fast-paced world, quick access to funds is often a necessity. Finmerkado understands this need and offers a streamlined approval process for personal loans. This can be especially beneficial in situations where funds are needed urgently, such as during medical emergencies or unexpected expenses.

- Competitive Interest Rates: Finmerkado offers both fixed and variable interest rates, allowing borrowers to choose the option that best fits their financial strategy. Fixed rates provide predictability, making it easier to budget, while variable rates, which fluctuate based on market conditions, may offer lower costs over time, albeit with some level of uncertainty.

- Simple Application Process: Applying for a personal loan with Finmerkado is straightforward. Applicants need to meet basic requirements such as age, income, government-issued ID, residency, and having a mobile phone number. This streamlined process ensures that potential borrowers can quickly determine their eligibility and move forward with their application.

- Opportunity for Credit Repair: For those looking to improve their credit score, successfully managing a personal loan from Finmerkado can be a significant step. On-time payments and adherence to loan terms can positively impact a borrower’s credit history, helping them rebuild or strengthen their credit profile over time.

Evaluating the Credibility of Finmerkado

When considering a personal loan, the credibility of the lending institution is paramount. Finmerkado’s credibility is underscored by several key factors:

- Regulatory Compliance: Finmerkado is registered with relevant government agencies in the Philippines, such as the Securities and Exchange Commission (SEC) and the Bangko Sentral ng Pilipinas (BSP). This registration ensures that the institution operates within the legal framework set by the government, providing an additional layer of security for borrowers.

- Transparency: Finmerkado is committed to transparency in its loan offerings. The institution clearly outlines interest rates, terms, and any associated fees in the loan contracts. This openness helps borrowers make informed decisions without the fear of hidden costs.

- Established Presence: Having operated in the financial market for several years, Finmerkado has built a reputation for reliability and trustworthiness. The institution’s experience in the field is further validated by its partnerships with other reputable financial institutions, as well as its achievements and recognition in the industry.

- Nationwide Accessibility: With several branches across the Philippines, Finmerkado ensures that its services are accessible to a wide range of borrowers. This extensive reach not only enhances convenience for customers but also reflects the institution’s stability and growth in the market.

- Positive Customer Feedback: A key indicator of Finmerkado’s reliability is the feedback from its customers. Many satisfied borrowers have shared positive reviews, highlighting the ease of the application process, the responsiveness of customer service, and the overall satisfaction with the loan terms.

Eligibility Criteria and Application Process

To be eligible for a personal loan from Finmerkado, applicants must meet specific criteria:

- Age: Applicants should be between 21 and 64 years old.

- Income: Meeting the minimum income requirements set by Finmerkado is essential. This ensures that borrowers have the financial capacity to repay the loan.

- Required Documents: Applicants must provide a government-issued ID and, optionally, proof of income or an employment contract.

- Residency: The loan is available to Filipino residents or local resident foreigners with a valid Philippine billing address.

- Mobile Number: A valid mobile phone number is required for communication and verification purposes.

Comparing Personal Loans

Before choosing a personal loan, it is crucial to compare different options available in the market. Factors such as loan limits, interest rates, additional fees, loan terms, and disbursement times should be carefully considered to ensure the loan aligns with the borrower’s financial needs and capabilities.

Finmerkado’s personal loans offer competitive terms and a borrower-friendly application process, making it a viable option for those in need of financial assistance. By prioritizing transparency, quick approval, and flexible loan options, Finmerkado stands out as a trustworthy microfinance institution in the Philippines.

In conclusion, Finmerkado provides a comprehensive personal loan service that caters to a variety of financial needs. With its commitment to transparency, regulatory compliance, and customer satisfaction, Finmerkado is well-positioned to support borrowers in managing their personal finances effectively.

On the partner site

04.10.24 11:11

Great experience, the loan process was quick, and the customer support was excellent.

10.09.24 21:46

I was amazed by how fast the approval and transfer process was.