Cashmum

«Cashmum» - Loan company summary:

CashMum Philippines, now operating under the formal business name Cashmum Lending Investors Corp., is a fully licensed lending entity providing accessible financing solutions across the Philippines.

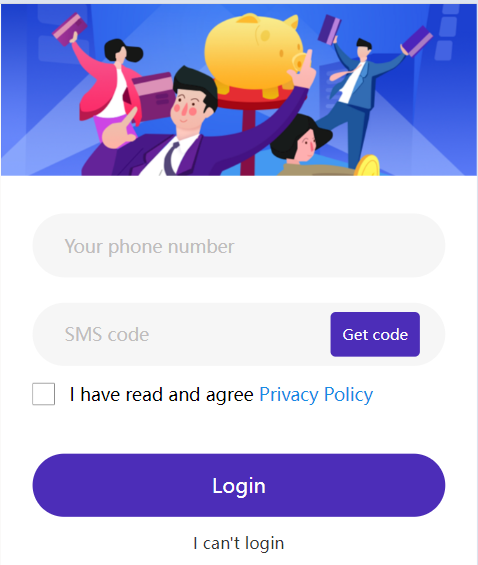

Accessible via both their streamlined website and user-friendly mobile app at CashMum.ph, the company simplifies the loan application process for its users. The platform allows applicants to easily monitor their application status, initiate new loan requests, and upload required documents efficiently. Typically, the approval process is swift, enabling applicants to gain access to funds within just a few hours.

What is CashMum?

CashMum represents a robust mobile lending application operated by Cashmum Lending Investors Corp., a company that operates legally and holds registration with the SEC under No: CS202102336 and C.A. No: 3413. This platform aims to streamline the online lending experience, providing individuals with fast and straightforward access to financial support.

Applicants are required to enter their personal details and, upon completion of document submission and subsequent approval, can quickly receive a loan. CashMum loans are designed to be a reliable and convenient source of rapid financial relief for Filipinos, catering to those caught between escalating living costs and sudden financial necessities. The service prides itself on its hassle-free loan acquisition process, designed to meet urgent financial needs efficiently.

What is a CashMum Loan?

In the Philippines, a CashMum loan stands as a practical financial resource. Offering loan amounts from PHP 5,000 to PHP 20,000 and flexible repayment periods ranging from 91 to 365 days, these loans provide immediate financial access. With competitive interest rates starting at just 1.5% per month, CashMum loans are structured to cater to a variety of financial situations, ensuring affordability and convenience for all applicants.

Is Cashmum legit?

CashMum is a recognized lender within the Philippine financial landscape, known for its adherence to legal requirements enforced by the Securities and Exchange Commission. This compliance assures borrowers that CashMum is a secure and dependable option for obtaining financial support swiftly.

If you’re considering a loan in the Philippines, it’s essential to choose a financially sound institution that is officially registered under the Securities and Exchange Commission (SEC).

| Loan Amount | PHP 5,000 to PHP 20,000 |

| Interest Rate (per day) | 0.05% – 0.17% |

| Payment Terms | 91 to 365 days |

| Application Processing Time | 2 to 24 hours |

| Borrower Age | Must be at least 21 years old |

| Required Documents | Valid government-issued ID, proof of income |

| Other Conditions | Interest-free period for the first 15 days; applicable only to first-time borrowers; subsequent loans might incur charges from day one. |

Our thorough examination confirmed that Cashmum is included in the SEC’s LIST OF RECORDED ONLINE LENDING PLATFORMS. This inclusion not only validates that Cashmum operates legally within the Philippines but also that it has successfully passed all requisite inspections by regulatory bodies, making it a trustworthy institution for financial services.

How to Get a Loan from CashMum

Securing financial support through CashMum is designed to be a straightforward and efficient process, tailored to meet the urgent financial needs of its clients. Here’s a step-by-step guide on how you can easily secure a loan with CashMum:

- Navigate to the CashMum Loan Application Platform: Begin by visiting the official CashMum website or by downloading the CashMum app from trusted sources.

- Fill Out the Application Form: Accurately complete the application form with your personal and financial information. This critical step allows CashMum to evaluate your loan eligibility and the amount you can borrow.

- Submit and Await Review: After filling out the form, submit your application through the platform. CashMum’s efficient team will then review your application without delay.

- Approval and Fund Disbursement: Once your loan is approved, the funds will be swiftly transferred directly to your bank account. CashMum prioritizes rapid processing to ensure you can address your financial needs as quickly as possible.

- Understand and Adhere to Loan Terms: It is crucial to thoroughly understand and adhere to the terms and conditions of your loan agreement with CashMum. Familiarizing yourself with these details ensures a clear and beneficial financial arrangement for both parties.

By following these steps, obtaining a loan from CashMum is a seamless process, from application to the receipt of funds, ensuring you can quickly access the financial support you need.

CashMum Loan Conditions Overview

This review provides a comprehensive analysis of CashMum’s loan offerings, crafted to meet the diverse needs of its clientele. CashMum’s loan terms are thoughtfully structured, featuring interest rates typically ranging between 3% to 5% monthly. A notable aspect of these loans is the initial 15-day interest-free period, offering borrowers a grace period with zero interest accrual, which allows for financial flexibility right at the start of the loan term.

Before committing to a CashMum loan, it’s advisable to review the effective annual interest rates, which stand at approximately 18.25% per annum for loans issued by CashMum in the Philippines. Here is a detailed list of the current interest rates by loan type, aiding in precise financial planning:

- Personal Loan: 1.5%

- Business Loan: 2.0%

- Education Loan: 1.75%

- Medical Loan: 1.85%

- Home Improvement Loan: 2.1%

For exact calculations, potential borrowers are encouraged to use the CashMum Philippines loan calculator or check rates directly via the CashMum loan application.

CashMum offers loans ranging from PHP 5,000 to PHP 20,000, accommodating a wide spectrum of financial requirements with repayment terms extending from 91 to 365 days. This flexibility ensures that borrowers can manage repayments comfortably without undue pressure.

CashMum is known for its rapid processing, with approval times between 2 to 12 hours, making it an excellent choice for those in urgent need of financial resources. Here are the basic terms and conditions of a CashMum loan:

- Maximum Loan Amount: 8,000 PHP

- Interest Rates: Annual percentage rates (APR) start at 35% and can be as low as 20%.

- Service Fee: Up to 10% of the approved loan amount, with a potential reduction to 5%

- Loan Term: From 91 days, extendable up to 120 days

- Processing Time: Noteworthy for its efficiency, the approval process can take as little as 3 minutes for those with lower credit limits.

Overall, CashMum’s loan offerings are designed to provide a balanced mix of flexibility, affordability, and convenience, catering effectively to the financial dynamics of its customers.

CashMum Loan Requirements

To qualify for a CashMum loan, applicants must fulfill certain criteria. Firstly, all applicants must be at least 21 years old, ensuring they are of legal age for financial agreements. Additionally, a valid government-issued ID is required to verify identity and proceed with the loan application. These measures are in place to confirm that all borrowers meet the legal age requirement and possess the necessary documents for identity verification, setting the stage for a straightforward loan acquisition process with CashMum.

How to Cancel a CashMum Loan

There may be circumstances where you need to cancel your CashMum loan. Here’s how you can go about it:

- Contact Customer Support: Begin by reaching out to CashMum’s customer support through phone, email, or live chat to state your desire to cancel the loan.

- Log In to Your Account: Alternatively, you can log into your CashMum account via their website or mobile app to explore cancellation options.

- Follow the Provided Instructions: Complete the cancellation by following the instructions specified by CashMum, ensuring you comply with any conditions they might have.

By adhering to these steps, you can successfully cancel your CashMum loan.

How to Repay Your CashMum Loan

CashMum offers several convenient repayment methods to suit different preferences:

- Bank Transfer: Directly transfer the due amount from your bank account to CashMum.

- E-Wallets: Utilize popular e-wallets such as Maya, GCash, or Dragon Loans for quick and secure payments.

- Cash Payments: Make payments in cash at partner outlets like Palawan Express, 7-Eleven, SM Bills, and Cebuana Lhuillier.

These options provide flexibility and ease for managing your loan repayments with CashMum.

Consequences of Unpaid CashMum Loan

Non-payment of a CashMum loan can lead to several adverse effects:

- Harassment from Collection Agencies: Borrowers may face persistent harassment from collection agents, including frequent calls, messages, and visits demanding payment.

- Online Lending Harassment in the Philippines: Defaulters may experience common harassment tactics used by collection agencies in the country.

Potential Charges for Non-Payment of CashMum Loan

Failing to repay a CashMum loan can result in the accrual of various charges:

- Late Payment Penalties and Processing Fees: Defaulting on your loan triggers additional charges, which can include late payment penalties and increased processing fees.

- CashMum Processing Fee: Be aware of potential processing fees that CashMum may apply to loan applications and transactions. Always review the terms and conditions to understand all applicable charges fully.

CashMum customer support

When you need assistance or have questions about your CashMum loan, there are several ways to get in touch with their dedicated customer service team:

- CashMum Philippines Hotline: For prompt responses to your inquiries, contact the CashMum hotline. This service is ideal for immediate assistance with any loan-related concerns.

- CashMum Branches: For face-to-face interaction, visit any of the CashMum branches. The staff there can offer personalized support and detailed guidance on loan management and repayment strategies.

- CashMum Head Office: For more detailed inquiries, you may direct your questions to the CashMum head office where the team provides comprehensive customer service.

- CashMum Office Hours: Make sure to check the operating hours of CashMum’s offices to ensure that you contact them at a time they are available to assist you.

For those requiring an instant reply, CashMum also provides a live chat feature on their website. This tool is specifically designed to offer quick and efficient help, connecting customers directly with customer service agents to address their needs without delay.

On the partner site

06.10.24 0:01

No paperwork or long waits, everything was done online. Great service!

02.09.24 2:34

I’ve never had such a fast loan approval experience before. Highly satisfied!

05.07.24 21:27

I found the loan process to be very user-friendly and efficient.